Where are we now with home working?

Jon Boys reflects on how home working has developed since the start of lockdown in 2020

Jon Boys reflects on how home working has developed since the start of lockdown in 2020

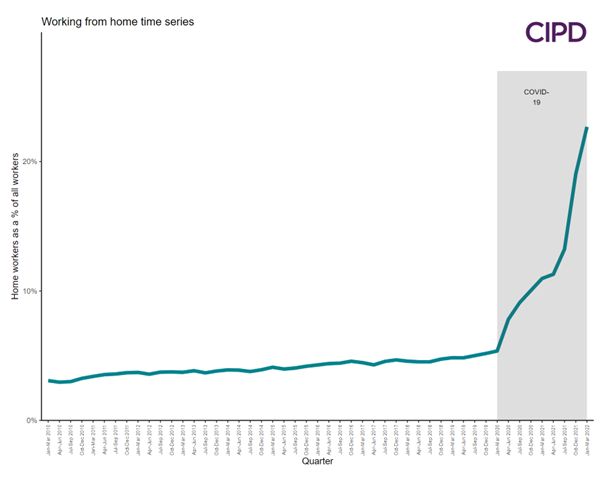

A week into lockdown in 2020, the CIPD published the report Megatrends: What’s driving the increase in remote working? It was written in January/February 2020 before we knew about COVID-19. Between 2000 and 2020, those people saying that their home was their main place of work had jumped from 3% to 5%. Although starting from a small base, this was a big jump and the time series suggested that it would continue to grow. Here is the original chart from the report.

And below is the updated chart, which now goes up to March 2022. The proportion of people saying that their main place of work is their own home now stands at 22% or more than four times greater than pre-pandemic.

Some may be asking, how can home workers be increasing right as the numbers of people going back into the office are increasing too? As ever, different data is measuring different things. As the pandemic wore on, more people started to acknowledge that home was their main place of work. Their perception of whether they were homeworkers and their roles were reclassified. It’s possible that a majority of these people are actually hybrid workers, perhaps doing two days in the office and three days at home (Conversely, many people may be three days in the office, two days at home and therefore not show up in this chart).

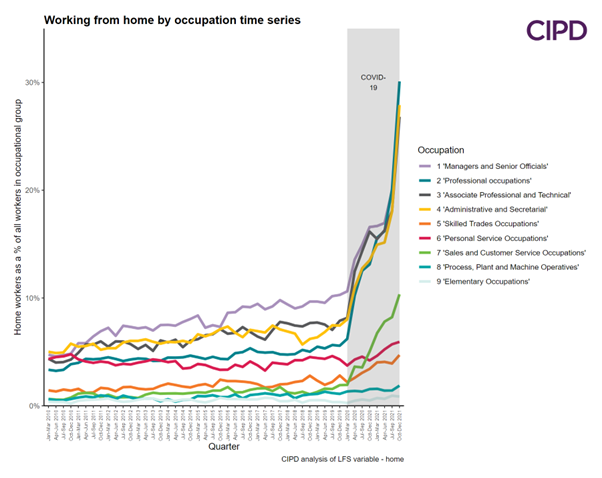

Another advantage of this dataset is that it is large and has plenty of variables to explore. We can split, for example, into broad occupational groups. The chart below clearly shows that the more office-based jobs (managerial, professional, and administrative) have made the switch to home working in much greater numbers. Interestingly some occupational groups, such as elementary occupations, and process plant and machine operatives, didn’t budge. Some jobs can’t be done from home. Indeed, it is always worth bearing in mind that the majority of people still work away from home.

Perhaps the most interesting aspect of the trend in these charts is that it does not yet look as if it has peaked. Over two years since the start of the pandemic, and it seems the dust has yet to settle. It’s possible that increasing travel costs, be they increased train fares or petrol prices, and reduced services as part of cost-cutting measures, could result in a positive feedback loop, further accelerating the trend for home working. Increased house prices may push prospective buyers further away from jobs, and this will increase commuting times and further entrench the home working trend.

Parts of Government are not keen on homeworking but have little power over the private sector to fight the trend, instead of focusing on civil servants. The debate has moved on from whether home working is good or bad and is now about what level of hybrid works best. This is sensible. In the pre-pandemic world, 30% of the workforce occasionally worked from one, and 25% worked part-time. Providing time for face-to-face collaboration and facilitating hybrid working was already a good idea.

The fact that home working was on the rise pre-pandemic, and has stayed elevated even after the risk of harm from Covid has receded, suggests that there was a latent demand for it and that the pandemic was the catalyst. Perhaps the biggest lesson for policymakers and businesses is to experiment with new ways of working because some of them might stick.

Jon s an experienced labour market analyst with expertise in pay and conditions, education and skills, and productivity.

Jon used quantitative techniques to uncover insights in labour market data, both publicly available and generated through CIPD surveys.

Use our range of practical tools to help you manage flexible, hybrid and remote working within your organisation

Find out what people professionals said about their working lives and career development prospects in our recent pulse survey

As artificial intelligence continues its rapid advancement and becomes the much touted focus for investment and development, we highlight the critical role of the people profession and explain how the CIPD and its members will be involved shaping its impact at work

A look at whether artificial intelligence can cover skills shortages by exploring the benefits of AI and the advantages that can be gained by using generative AI such as ChatGPT

Jon Boys discusses the benefits of generative AI tools, and how organisations can utilise them