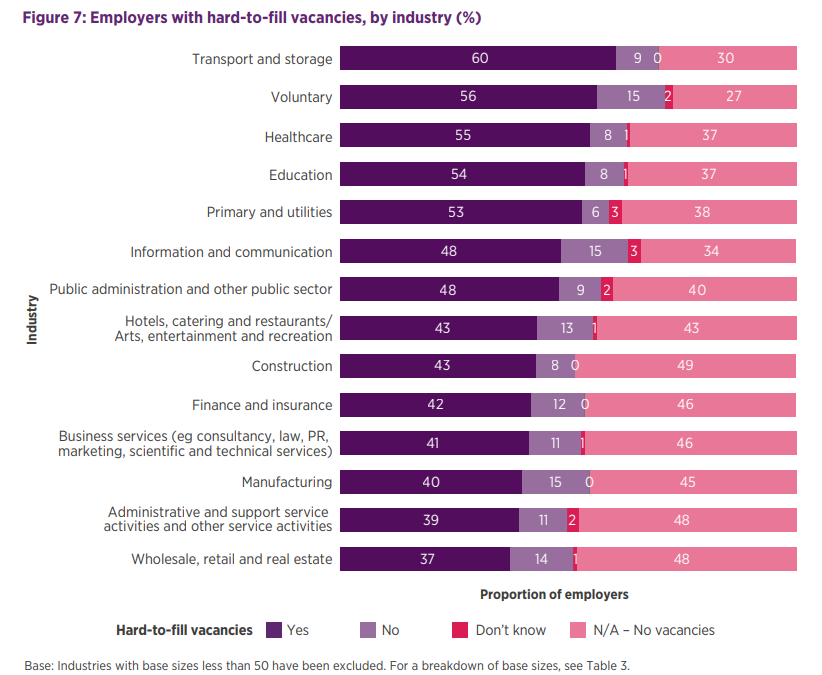

Hard to fill vacancies

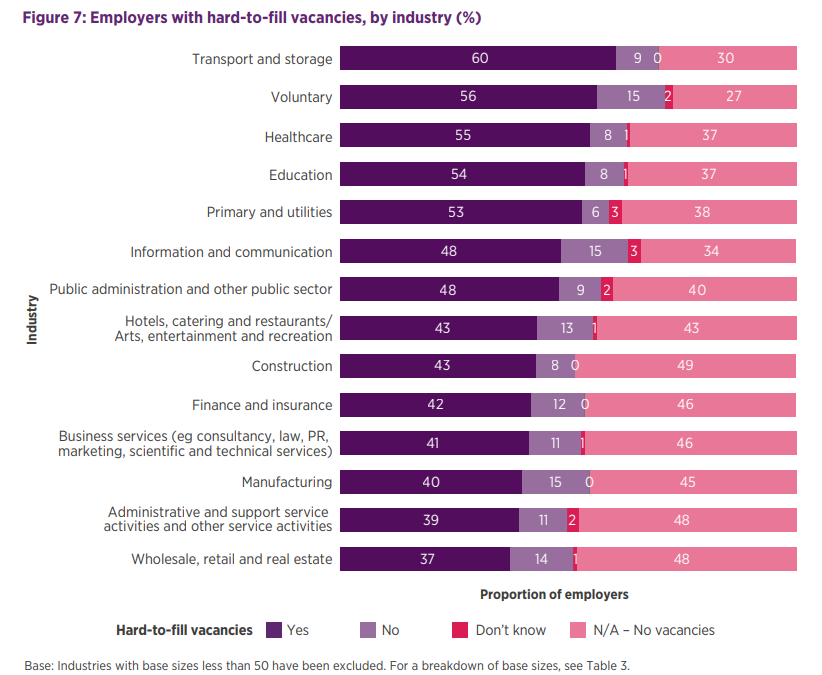

The proportion of employers who had hard to fill vacancies remained high in the last quarter (46%), with above average levels in Transport and storage; Voluntary; Healthcare; Education; Primary and Utilities; Information and communications; and Public administration and other public sector. Among these employers just 8% expect the number of hard to fill vacancies to decrease over the next 6 months.

To address hard-to-fill vacancies, 47% of employers have upskilled existing staff in the last 6 months similar to the level (44%) who plan to do so in the future. However, the rate of employers who have risen wages over the last 6 months (44%) is notably higher than the proportion of employers who plan to raise wages in the future in response to hard-to-fill vacancies (24%). This points to a more internal facing employment outlook, with employers diverting wage budgets from new hires towards their existing workforce to combat the cost-of-living crisis.

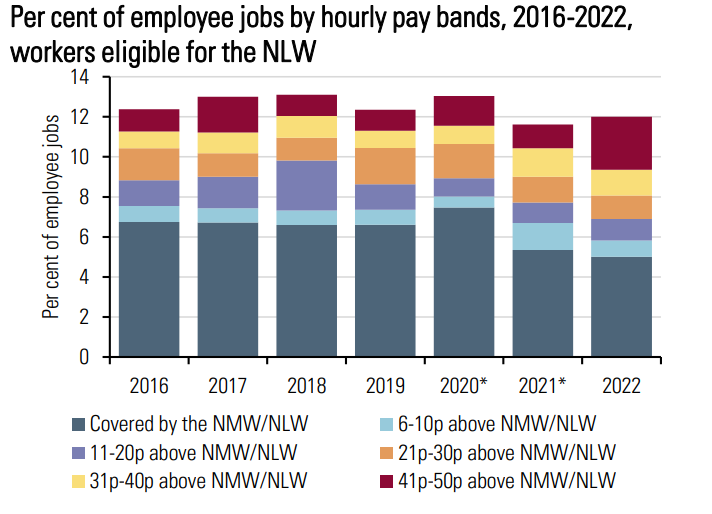

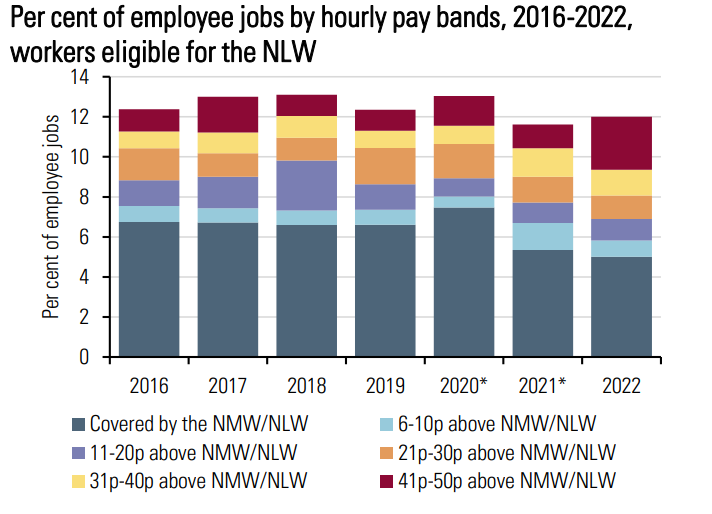

This is likely to be more evident in low-paying sectors going forward as the Government in their Autumn Statement accepted the Low Pay Commissions (LPC) recommendations of a 9.7% rise in the National Living Wage from April 2023 to protect the living standards of low-paid workers. This represents an increase of 92p. This will affect a huge number of employers and employees alike with LPC analysis showing that in April 2022 12% of all employees earnt within 50p of the National Living Wage. The LPC also found that “While employers were concerned about the forthcoming rise in the NLW, they were more concerned about other cost pressures. The majority thought pay would need to rise because of the tight labour market and because low-paid workers needed a response to the increase in inflation.”

Cost of living crisis

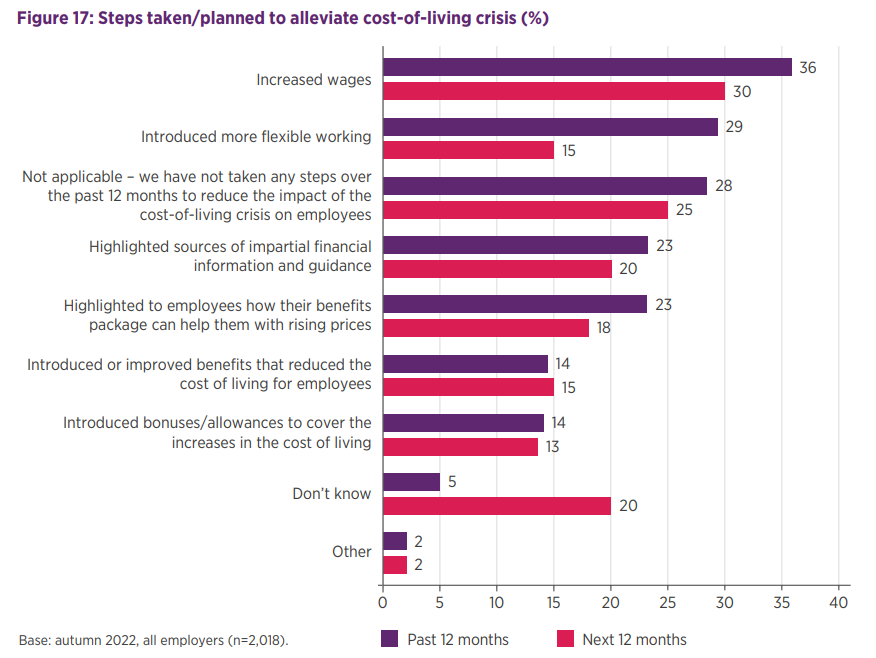

This quarters LMO – written to a backdrop of 10.7 %inflation (ONS)- had a particular focus on the cost of living crisis, with a more detailed insight into these findings found here. Twelve per cent of employers plan to give all staff a lump sum, while a further one in ten plan to give some staff a lump sum. Of those employers giving a cash lump sum to some staff, 43% are giving it to low-wage employees only.

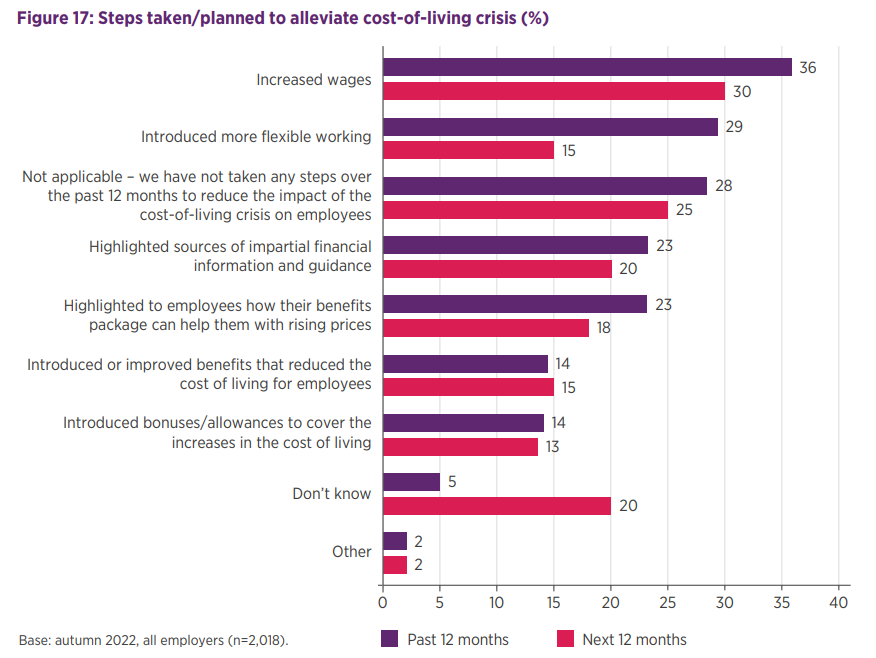

Generally, employers have taken action and plan to support employees through increased wages, instead of lump sum payments. This was seen as the most effective mechanism employers had to support employees during the cost-of-living crisis. In the last 12 months, 36% of employers have increased wages, with 30% planning to do so in the next 12 months.

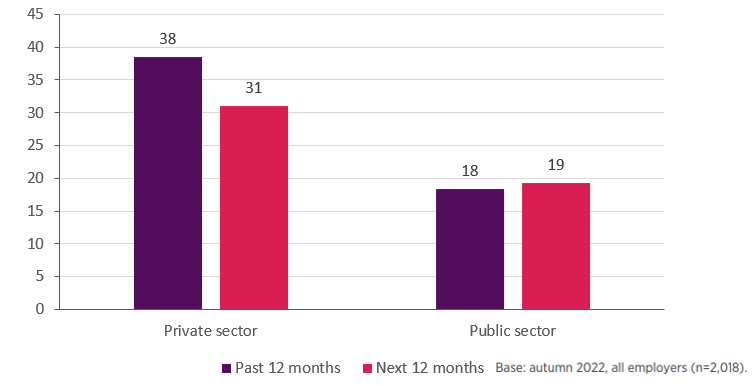

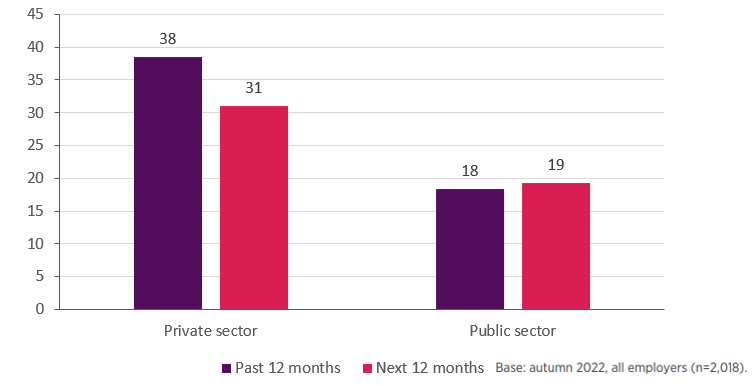

These figures mask the significant differences between the private and public sectors in their ability to increase wages. Just 19% of public sector employers surveyed planned to alleviate the cost-of-living crisis on employees with increased wages compared to 31% of private sector employers.

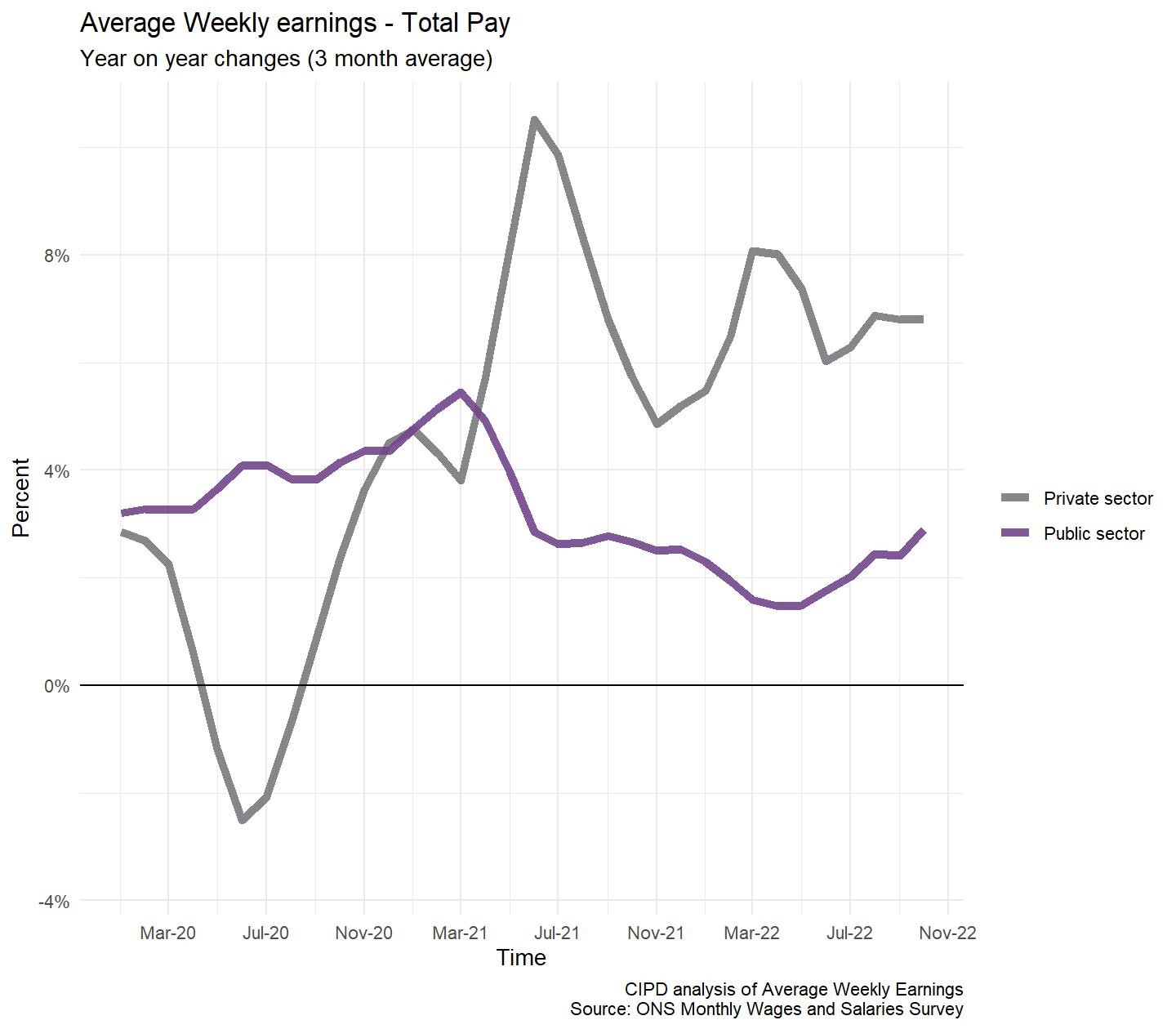

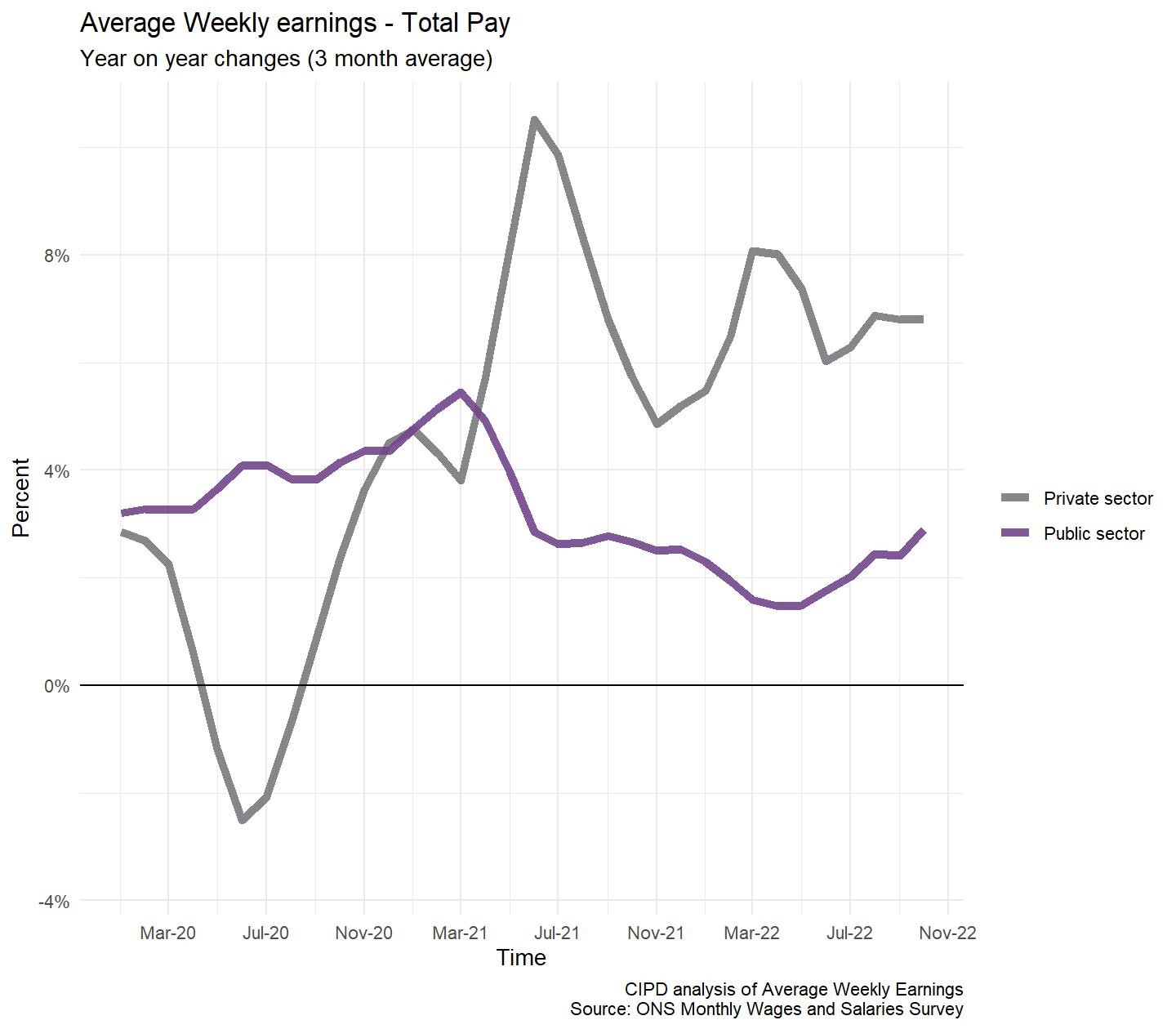

Findings from the LMO suggest that median expected basic pay increases stands at 4% for all employers, the highest overall net figure in the LMO’s current time series dating back to 2012. With 5% basic pay increases in the private sector, compared to just 3% in the public sector. This disparity between private and public sector pay nominal wage rises is also evident in the latest labour market stats, an area of focus on many of the media outlets last week (BBC, Guardian, FT, Evening Standard).

Conclusion

Employers face a difficult period ahead with rising energy costs making everything more expensive. There will be hard decisions to come around salary increases with the vast majority of employers unable to increase wages in line with inflation leading to cuts to pay in real terms. This is likely to be more common in the public sector, with minimal increases in government department budgets in the Autumn Statement. A winter of discontent lies ahead with public sectors strikes over pay anticipated by nurses, ambulance workers, border force, driving examiners, midwives and teachers. This is in addition to highly unionised occupations such as train drivers, university staff and postal workers. The number of days of strike action across the winter period is likely to be well above the already high 982,000 working days lost to labour disputes between August and October 2022. So while the economy is currently entering a shallow recession, with the Bank of England forecasting unemployment to rise, steadying the ship to deal with a “made in Russia” inflationary crisis is the focus for government and employers alike.