Recruitment and redundancy outlook

Stay up to date with the latest recruitment and redundancy trends in the UK.

The CIPD’s Labour Market Outlook – Winter 2023-24 reveals falling pay increase expectations for the first time since the pandemic

Employers’ basic pay increase expectations over the next 12 months have fallen for the first time since Spring 2020. Having held steady at 5% for more than a year, UK employers’ expected basic pay increases have fallen to 4%, marking the first fall since the start of the pandemic. The median expected basic pay increase in the private sector has fallen from 5% to 4% since the last quarter while pay expectations in the public sector have fallen further from 5% to 3%. This differential has the potential to make public sector recruitment and retention more difficult.

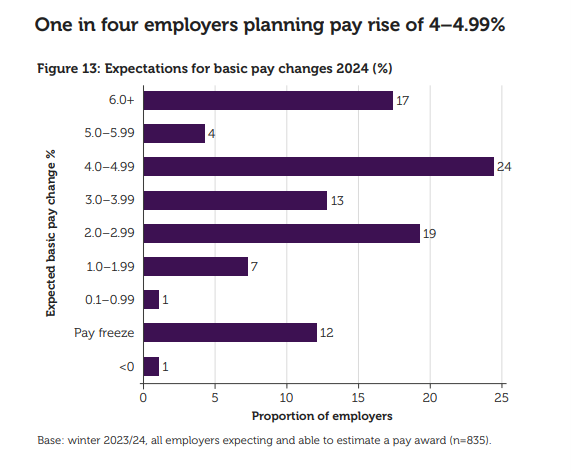

Looking at the make-up of expected pay awards for 2024, we see that 24% organisations plan to increase base pay by 4–4.99%. 19% plan to increase pay by 2–2.99%, with a similar proportion (17%) preparing for pay rises of above 6% in 2024. Some organisations are planning a pay freeze (12%).

Employees will continue to have an appetite for higher pay in 2024, as food inflation remains persistently high at 7%. Some employees have had falling real pay, as the cost-of-living crisis took a large bite into living standards. Currently 6 in 10 adults in Great Britain say they are spending less on non-essentials because of increases in living costs. 4 in 10 are also spending less on food shopping and essentials (40%) or using less fuel such as gas or electricity in their homes (44%).

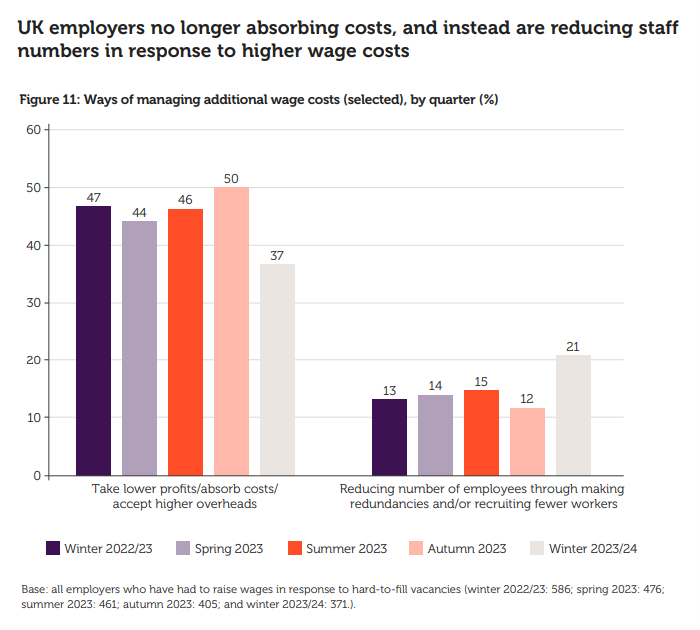

The employer–employee tension over pay is something that is likely to plague HR professionals across the country this year. Indeed, a recent poll by the CIPD found that three quarters of respondents did not think they would meet employee pay expectations in 2024. The LMO reports that of employers who have had to raise wages in response to hard-to-fill vacancies, fewer this quarter (37%) are taking lower profits, absorbing costs, or accepting higher overheads, compared to 12 months ago (47%). Instead, the level of employers who are reducing headcount through redundancies or recruiting fewer workers has increased from 13% a year ago to 21% this quarter.

Our data shows that it is the latter, with falling vacancies expected in the next six months. The level of employers who anticipate significant problems in filling vacancies has fallen from 29% a year ago to 21% this quarter. A further 35% still anticipate minor problems. Official figures have shown falling vacancies each month for the last 18 months, despite remaining above pre-pandemic levels.

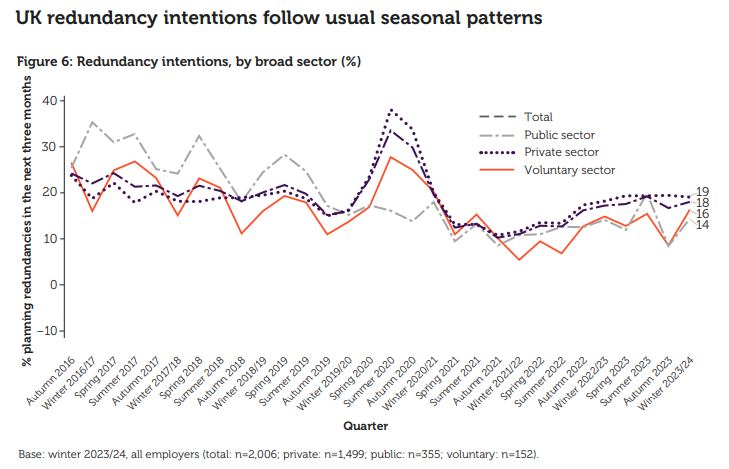

Overall, only 18% of employers are planning to make redundancies in the three months to March 2024. The level of employers planning to make redundances in the next three months has remained at a similar level both overall and in the private sector since winter 2022/23.

The Bank of England governor, warned against putting “too much weight” on fact the UK slipped into technical recession (two consecutive quarters of negative economic growth) in the final six months of 2023. But we know that a return to higher living standards and profitability can only be achieved through a return to positive growth. To do so there needs to be a focus on boosting productivity by investing in workplace skills and technology. As the professional body for HR and people professionals we advocate that the workforce is a key driver of productivity, profitability, and value for organisations. Investing in skills and training, people management and productivity gains, will be fundamental in helping organisations thrive in 2024 and beyond.

Coverage of this quarter’s LMO featured in the Guardian, The Times, the Telegraph, the Evening Standard and the Mirror. The report and video summary can be accessed from the CIPD Labour Market Outlook page.

Stay up to date with the latest recruitment and redundancy trends in the UK.

A manifesto for fair, skilled and innovative work, setting out CIPD’s recommendations for policy-makers to strengthen the Scottish labour market

Find out what people professionals said about their working lives and career development prospects in our recent pulse survey

As artificial intelligence continues its rapid advancement and becomes the much touted focus for investment and development, we highlight the critical role of the people profession and explain how the CIPD and its members will be involved shaping its impact at work

A look at whether artificial intelligence can cover skills shortages by exploring the benefits of AI and the advantages that can be gained by using generative AI such as ChatGPT

Jon Boys discusses the benefits of generative AI tools, and how organisations can utilise them